are hoa fees tax deductible for home office

HOA fees can be partially deductible for self-employed people with home offices. Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees.

What Hoa Costs Are Tax Deductible Aps Management

A portion of the fees associated solely with the office are considered as tax deductible.

. The IRS views them as personal expenses not a tax rendering them ineligible as tax deductible. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house. If you are self-employed then as long as you are using the room exclusively 100 for business use you will be able to claim a home office expense.

However if you have an office in your home that you use in connection with a trade or business then you may be. You can deduct certain expenses including HOA fees related to your home office. It is important to remember that according to 2018s Tax Cuts and Jobs Act this deduction is only allowable for those who are self-employed.

If you are working. Taxpayers must meet specific requirements to claim home expenses as. Once you figure out the percentage youll use that number to deduct your HOA fees.

Unfortunately homeowners association HOA fees paid on your personal residence are not deductible. Are HOA Fees Tax Deductible. Additionally if you use the home as your personal residence your HOA fee wont be tax deductible in that case either unless you run a business out of that home.

Generally if you are a first time homebuyer your HOA fees will almost never be tax deductible. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. Can HOA fees be tax-deductible.

You need to report HOA fees on your Schedule E form 1040 when you submit your tax return. If the home is a rental property however HOA fees do become deductible. This is an exception to the rule.

Once you figure out the. Though it is important to keep in. In general HOA fees are not tax deductible in California.

Do you get a home office tax deduction. However the new law only allows. They are partially or wholly deductible if the house is rented out.

So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. Yes the prorated amount of the maintenance fees that apply to your home office are tax deductible. Yes you can write off HOA fees if you use your home as an office.

The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. The home office deduction Form 8829 is available to both homeowners and renters. In general homeowners association HOA fees arent deductible on your federal tax return.

There are a few exceptions though. You can also deduct 10 of your HOA fees. Investment properties are treated completely differently from your home.

It is important to remember that according to 2018s Tax Cuts and Jobs Act this deduction is only allowable for those who are self-employed. There may be exceptions however if you rent the home or have a home office. Yes hoa fees are deductible on a home you dont live in that you use as a rental property.

For properties used as rentals businesses or which include a home office the fees full or. Yes you can include a portion of your HOA and mortgage interest if you are eligible to claim a home office expense. Are HOA fees tax deductible.

A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated community apartment or other type of planned development. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. Employees working remotely for an employer will get no home office deduction.

This is being off-set by the doubling of the standard deduction on your tax return. Additionally an HOA capital improvement assessment could increase the cost basis of your home which could have several tax consequences. When HOA Expenses Are Tax Deductible If you use part of your home as an office you can deduct part of your home expenses including the fees.

You can also deduct 10 of your HOA fees. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Simply so are home association fees tax deductible.

Tax Deductible Home Improvements Yes HOA fees are deductible for home offices. Tax deductibles can save you a couple of dollars especially if you have other expenses taking up a bulk of your income and would like to salvage as many pennies as you can. In this scenario the IRS sees these fees as property maintenance costs.

If you are self-employed and have a home office you can deduct some of your expenses related to that home office including HOA fees. Employees are not eligible to claim the home office deduction. There are certain expenses taxpayers can deduct.

However if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a portion of the HOA fees that relate to that office. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. If you use 10 of your home as an office the same percentage of hoa fees is deductible.

Before claiming your HOA fees you will have to determine how much space your home office takes up in your house. Yes HOA fees are deductible for home offices. Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees.

You can also deduct 10 of your hoa fees. Are home taxes deductible. If the property is a rental property HOA fees do become tax-deductible.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Homeowners who itemize their tax returns can deduct property taxes they pay on. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible.

They include mortgage interest insurance utilities repairs maintenance depreciation and rent. But there are exceptions.

Are Hoa Fees Tax Deductible Clark Simson Miller

Can You Claim Hoa Fees On Your Taxes

Are Hoa Fees Tax Deductible Here S What You Need To Know

Form 8829 For The Home Office Deduction Credit Karma Tax

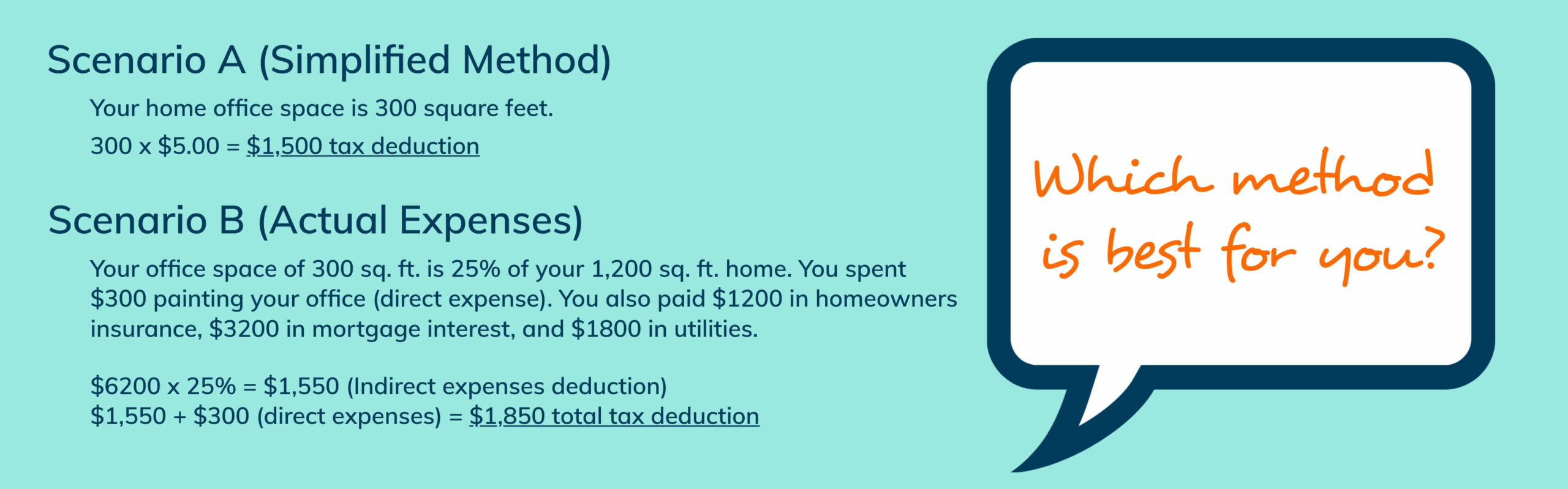

The Home Office Deduction Simplified Vs Actual Expense Method

Home Office Deduction An Easy Guide Tax Defense Network

Tax Deductions For Home Office A Guide For Small Businesses

Quick Answer Can You Deduct Maintenance Expenses On A Principal Residence Bikehike

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

Are Hoa Fees Tax Deductible Experian

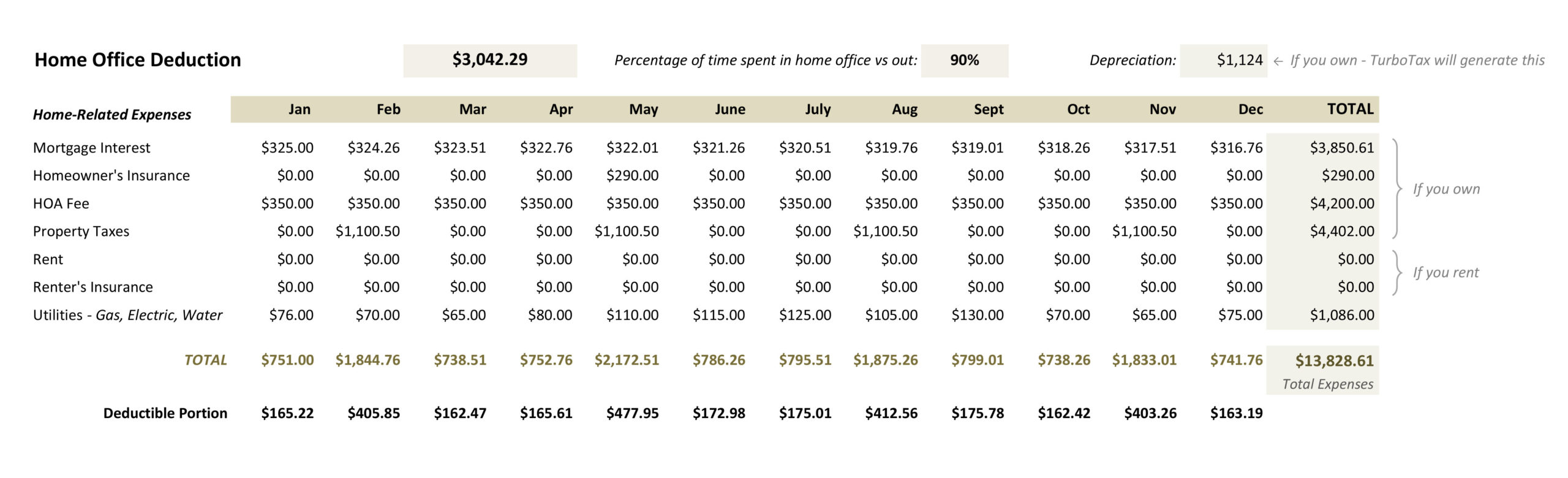

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Tax Deductions For Home Office A Guide For Small Businesses

Are Hoa Fees Tax Deductible Clark Simson Miller

What Are Tax Deductions The Turbotax Blog